Rutherford Health secures loan for proton therapy

Rutherford Health today announced that it has secured a £20million facility with Triple Point Investment Management, the specialist impact investment manager.

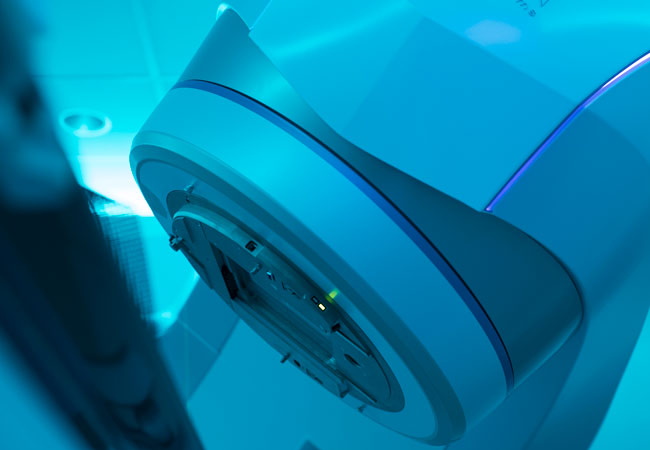

The nature of the Impact-Linked Pricing structure means Rutherford can enjoy more favourable loan terms as patient numbers increase at the company's three cancer centres in the UK, which offer proton beam therapy and a wide range of advanced cancer services.

Mike Moran, chief executive officer, Rutherford Health plc, said:

"We are delighted to have secured this forward thinking facility with Triple Point which shares our goal of widening access to the most advanced cancer treatments. Structuring a loan facility in a way that encourages accessibility to our services is a progressive approach.

"This investment will lead to the continued expansion of our services, particularly proton beam therapy. Triple Point is a proven investment manager committed to delivering social and public good and our services to patients fit extremely well into that ethos."

Steve Gordon, Programme Manager at Triple Point, said:

"Triple Point's first of its kind, Impact-Linked Pricing offering, helps align our goals with those of Rutherford Health in a virtuous circle. Simply put, we are all incentivised to increase access to the cancer treatment centres which, in turn, will trigger more favourable loan terms, which will unlock more resource and accelerate availability even further.

"Triple Point already has extensive experience of investing in impactful technologies on behalf of the UK's public and private sector healthcare providers. We are delighted to play a small part in support of Rutherford's aims to open their world-class treatments to more people in the UK and beyond from their state of the art new facilities."